maryland student loan tax credit 2020

Trusted by Over 1000000 Customers. Ad Apply for a Loan with a Trusted Lender.

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Amount of wages and salaries disallowed as a deduction due to the work opportunity credit.

. Expert Reviews Analysis. Quick and Easy Application. The Homestead Credit limits the increase.

Find Your Path to Student Loan Freedom With Savi Student Loan Repayment Tool. Will have maintained residency within the state of Maryland for the 2020 tax year Have incurred 20000 or more in. There were 5145 applicants who attended in-state institutions and will each receive 1067 in tax credits while 4010 eligible applicants attended out-of-state institutions.

To help homeowners deal with large assessment increases on their principal residence state law has established the Homestead Property Tax Credit. Multi-Year Approval Options Available. This page is a benefit walk-through guide for How.

Ad Apply for a Loan with a Trusted Lender. Fielder announced Monday the awarding of nearly 9 million in tax credits for. Additional prioritization criteria are set forth in 10-740 of the Tax-General Article of the Annotated Code of Maryland and in the implementing regulations.

Ad Do Your 2021 2020 2019 2018 Taxes in Mins Past Tax Free to Try. To anyone who applied for the MHEC student loan debt relief tax credit for 2020 you may want to check your applicationaward status on the Maryland OneStop portal to see if you were. The Student Loan Debt Relief Tax Credit may be claimed on Form 502CR by certain qualified taxpayers in the amount certified by the Maryland Higher Education Commission.

5 28550 reviews Summary. The Student Loan Debt Relief Tax Credit may be claimed on Form 502CR by certain qualified taxpayers in the amount certified by the Maryland Higher Education Commission. The student loan debt relief tax credit is a program created under 10 -740 of the tax -general article of the annotated code of maryland to provide an income tax credit for maryland.

Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt. Ad Get Instantly Matched with the Best Loans For Colleges in USA. Citizens Offers Multiple Loan Options That Fit Your Needs.

Get Instantly Matched with the Ideal College Loan Options For You. Increasing from 5000 to 100000 the amount of the Student Loan Debt Relief Tax Credit that certain individuals with a certain amount of student loan debt may claim against the State. Student Loan Debt Relief Tax Credit for Tax Year 2020.

Citizens Offers Multiple Loan Options That Fit Your Needs. Easy Fast Secure. If the credit is more than the taxes you would otherwise owe you will receive a tax refund for the difference.

The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes. If the credit is more than the taxes you would otherwise owe you will receive a. Multi-Year Approval Options Available.

Get Rid Of The Guesswork And Have Confidence Filing With Americas Leader In Taxes. Easy Fast Secure. Governor Hogan Announces Tax Year 2020 Award of 9 Million in Tax Credits for Student Loan Debt Governor Larry Hogan and Maryland Higher Education Commission MHEC Secretary Dr.

For example if you owe 800 in taxes without the credit and then claim a 1000. Ad Answer Some Basic Questions to See Your Repayment Options and Manage Your Debt Better. 06092020 1215 AM Average star voting.

Do Your 2021 2020 any past year return online Past Tax Free to Try. Ad File State And Federal For Free With TurboTax Free Edition. 2020 Maryland Statutes Tax - General Title 10 - Income Tax Subtitle 7 - Income Tax Credits Section 10-740 - Student Loan Debt Relief Tax Credit.

Larry Hogan and Maryland Higher Education Commission Secretary Dr. Amount of student loan indebtedness discharged Attach notice.

Student Loans A Teacher Penalty Is Crushing Generations Of Educators With Debt

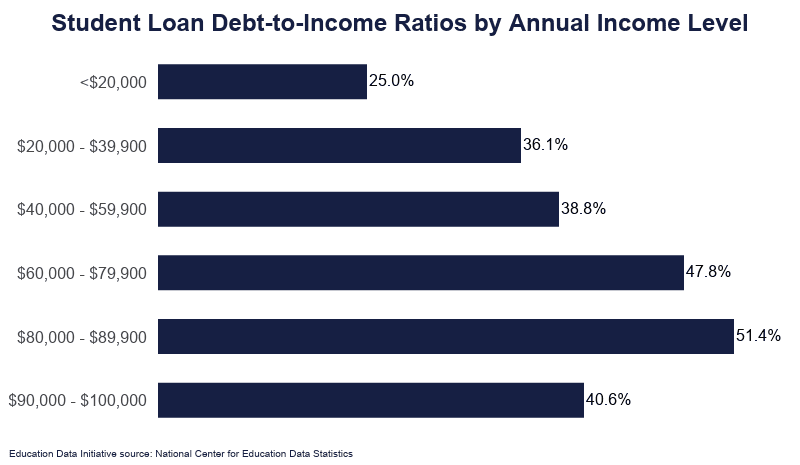

Student Loan Debt By Income Level 2022 Data Analysis

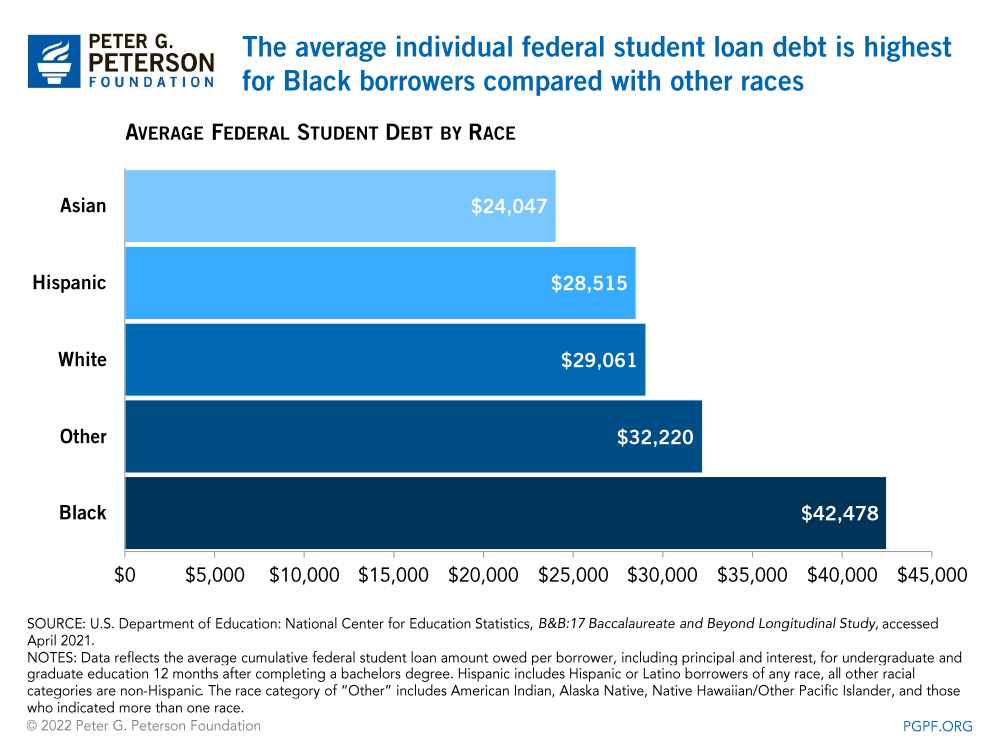

5 Charts That Explain The Student Debt Crisis Foundation For Economic Education

Latest White House Plan Would Forgive 10 000 In Student Debt Per Borrower The Washington Post

5 Charts That Explain The Student Debt Crisis Foundation For Economic Education

More Companies Are Wooing Workers By Paying Off Student Debt Money

What Are The Pros And Cons Of Student Loan Forgiveness

Latest White House Plan Would Forgive 10 000 In Student Debt Per Borrower The Washington Post

Student Loan Debt Statistics 2021 Update Policy Advice

Can And Will Biden Cancel Student Debt For 43 Million Americans Poynter

Can I Get A Student Loan Tax Deduction The Turbotax Blog

What Are The Pros And Cons Of Student Loan Forgiveness

Current Student Loans News For The Week Of Feb 14 2022 Bankrate

Student Loans Taxes Deductions Filing Returns And Retirement White Coat Investor

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Student Loan Debt Statistics In 2021 A Record 1 7 Trillion

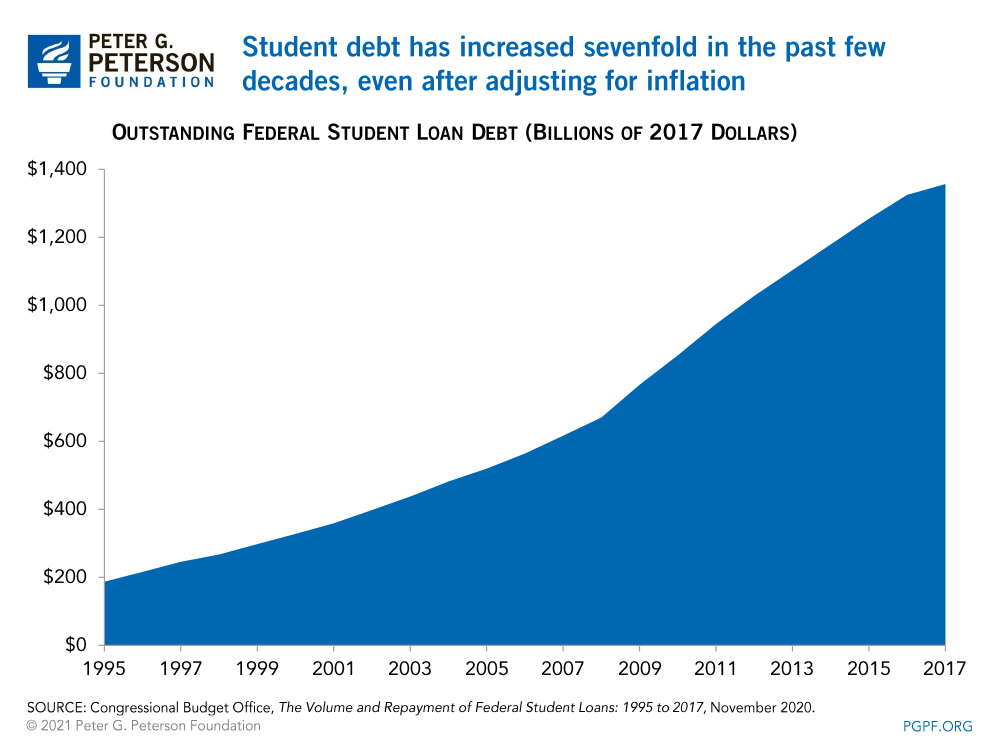

Student Debt Has Increased Sevenfold Over The Last Couple Decades Here S Why

Student Loan Debt Statistics 2021 Update Policy Advice

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero